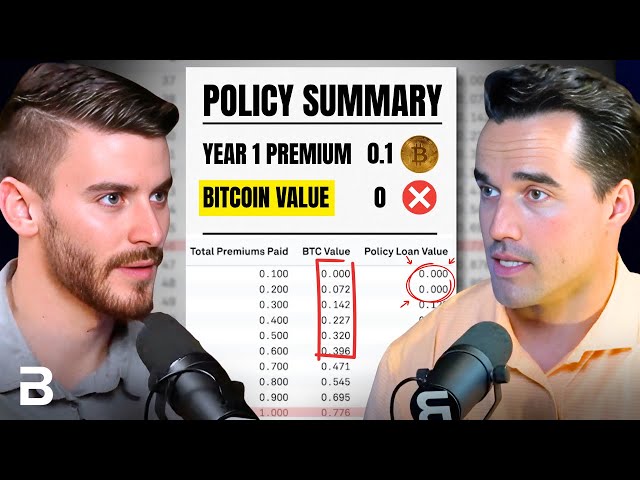

Your policy takes effect the moment you pay your first premium, and as long as it remains active, the full death benefit is guaranteed with a fixed number of Bitcoin—whether you pass away after just one payment or after all ten are made.

Learn moreWe invest for Bitcoin–not dollar–returns, under the rules of our regulator, so it grows over time. This means your beneficiaries get more Bitcoin out than what you put in without the usual tax burden on its growth.

Learn moreYou can borrow Bitcoin against your policy after two years. The borrowed BTC adopts a new, stepped-up cost basis equal to the fair market value of BTC at the time of the loan, meaning you can sell it immediately at cost. This means if BTC appreciates in the future you can borrow against your policy, sell the new BTC immediately, and have the option to either repay the loan at some point or leave it to be covered by your death benefit.

Learn moreNo need to worry about complicated hardware wallets or custodial setups. When your policy pays out, Meanwhile handles the transfer, sending Bitcoin directly to your beneficiaries.

Learn more

Jason breaks down Meanwhile's vision for Bitcoin protection

Anthony Pompliano interviews our CEO, Zac Townsend

Jason on what problems Bitcoin-denominated Life Insurance solves

Watch us on Natalie Brunell's Coin Stories podcast

Jason on BTC Life Insurance at the Blockchain Futurist Conference

Building Meanwhile, the first Bitcoin Life Insurance company

Zac sits down with Mark Moss to discuss Meanwhile

They created a Bitcoin-only Life Insurance company

Listen to our podcast with Stephan Livera

The Wolf of All Streets Podcast

Zac joined Robert Breedlove on "What is Money?" to discuss Bitcoin as a store of value and the role of life insurance in modern economies

Life insurance is about certainty. We honor that with guaranteed payouts, conservative investment strategies and disciplined risk management. As a financial institution licensed by a global leader in insurance regulation, your policy (and your legacy) are secure.

At Meanwhile, transparency is built into everything we do. We simplify complex decisions with the help of AI-powered underwriting—no hidden bias, no shoddy guesswork, you'll know exactly how your policy is evaluated and why.

Life insurance hasn't changed in hundreds of years, but the world has. Meanwhile is built for the future, offering the world's first and only Bitcoin-denominated life insurance. Now you can protect and grow your wealth in Bitcoin for generations to come.

Spend 5 minutes completing our form and then one of our wealth planning experts will reach out to you to answer any questions you have.

44 Montgomery Street, Suite 1480

San Francisco, CA 94104

Magnolia Towers, 2nd Floor, No. 15 Parliament Street

Hamilton HM 12, Bermuda

Meanwhile Insurance Bitcoin (Bermuda) Limited ("Meanwhile") is a life insurance carrier licensed and regulated by the Bermuda Monetary Authority.

Applications for Meanwhile's insurance products will only be received and reviewed by the company at its offices in Bermuda, and all offers and sales of its insurance products will only be made in Bermuda. Meanwhile does not conduct insurance business in any other jurisdiction.

The material on this website should not be construed as any solicitation to buy, offer to sell, or submit an application for the purchase of any insurance product in any jurisdiction other than Bermuda. Meanwhile may initially make hypothetical illustrations available.

These should be construed as illustrative only and do not constitute a proposal to enter into an insurance contract or an undertaking to offer insurance coverage under any specific terms and conditions in any jurisdiction. Only personnel of Meanwhile are authorized to make representations regarding its insurance products. Any materials which have not been prepared by Meanwhile should not be considered as representations by Meanwhile.

Neither Meanwhile Insurance Bitcoin (Bermuda) Limited nor its affiliates Meanwhile Services (Bermuda) Limited and Meanwhile Incorporated, are lawyers or accountants. They do not provide legal or tax advice. You are wholly responsible for obtaining your own legal and tax advice.